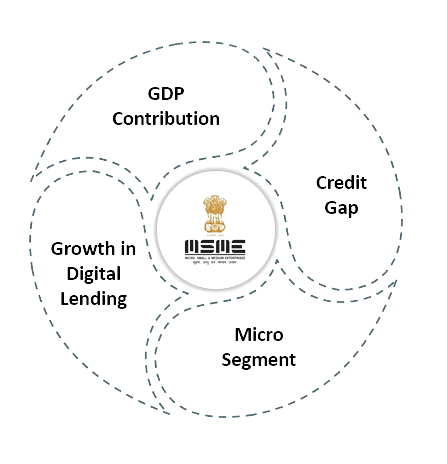

MSMEs plays a crucial role to India’s Economy, contributing almost 30% to the GDP with 45% share in total employment.

MSME count is expected to touch 75mn with 32% coming from the Micro segment.

Micro segment is leading the credit origination within MSME, having growth of 28% in terms of volume during Q2-FY25 versus 7% in Small & 9% in the Medium segment.

Micro segment credit origination is growing at a CAGR of 12%.

With an estimated credit requirement of INR 33tn by MSMEs, formal credit supply addresses only 1/3rd of it, this gap majorly impacts the Micro Entrepreneur's.

Insufficient finance creates roadblocks to their growth, resulting them to be dependent on informal sources.

Even after Govt’s focus towards digital connectivity coupled with availability of latest technologies, still the digital presence in credit origination of MSME is expected to touch only to 24% by FY26, up from 11% in FY23.

MSME/Micro Landscape

Sources-MSME Deptt & Few Research Reports.